Using the Tools in Your Performance Excellence Toolbox: Part 19 Benchmarking Preparation

This is the ninetieth in a series of posts on using performance excellence tools. Benchmarking is a tool that can really help you determine the best solution to your problem. This post will begin to cover the preparation for the benchmarking exercise.

You have enlisted your benchmarking partner(s)[1]. As difficult as that might have been, you now need to start to prepare for the benchmarking itself the preparation is even harder.

Preparation is critical. A benchmarking exercise is not a bull session. You need to research, document and rehearse your objectives for the meeting.

The key is successful time management. You are not shooting the breeze with your benchmarking partner. They have graciously given up some of their valuable time to work with you, regardless if you are sharing information with them or not, it is an imposition on them. You cannot waste their time. You can waste your time all you want as long as your management will tolerate it, which I hope is not at all.

In identifying your benchmarking partner, you have done some research into their process otherwise why would you have selected them? Oops, you did not research their process! Now you have to do it. Suppose you find that they are not the best/better practice, what now? Do you have to back out? Yes, you do and the politics of that is all on you.

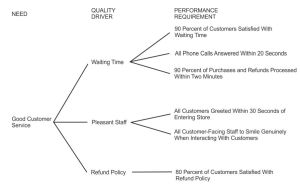

So rule one, do most of your research as part of the step in identifying best practices. You have identified the problem that you need to benchmark and hopefully established your CTQ’s.

Suppose you are running your local Meals on Wheels. You need to improve your delivery system. Who has the best of breed in delivery? You find businesses that do delivery as a core business function. USPS, FedEx, UPS for example.

But you are a small outfit how can you get them to work with you? Two approaches. First, the big guys work out of local facilities. Go after them at the local level. Second, there are successful local delivery services that may help. They have to be doing something right in order to compete with the big guys.

They agree to meet with you. What are you going to ask them? We’ll discuss this in the next post.

[1] Your process may cross several functions. You want to benchmark the best in each of the functions. To get the most out of the benchmarking exercise, you may want to or need to benchmark more than one organization or process to gain the information needed.

For example, consider you are revamping your entire back office functions, human resources, accounts payable, accounts receivable, procurement, etc. You need to identify the best practitioners for each of these areas.